Weekly Market Report

For Week Ending November 13, 2021

For Week Ending November 13, 2021

The Federal Housing Finance Agency may soon increase conforming loan limits, according to the Wall Street Journal, with Fannie Mae and Freddie Mac expected to back mortgage loans close to $1 million dollars in high-cost markets, and loans up to $650K in other markets, beginning in 2022. The final loan limits are expected to be announced November 30th. The projected increases are meant to keep pace with the historic rise of sales prices in the last year. Conforming loans often offer lower interest rates and smaller down payments, making it more affordable and easier for some borrowers to purchase a home.

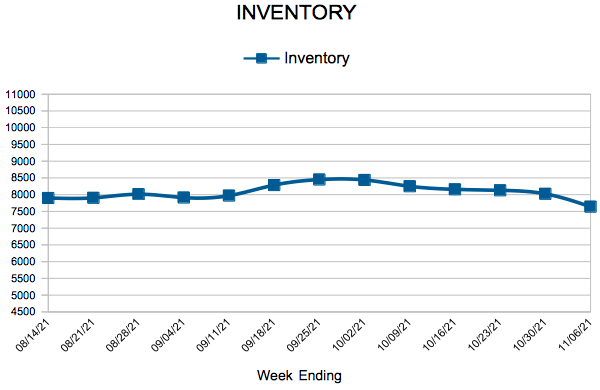

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING NOVEMBER 13:

- New Listings increased 9.3% to 1,100

- Pending Sales increased 2.5% to 1,173

- Inventory decreased 14.3% to 7,466

FOR THE MONTH OF OCTOBER:

- Median Sales Price increased 7.9% to $340,000

- Days on Market decreased 22.9% to 27

- Percent of Original List Price Received decreased 0.2% to 100.3%

- Months Supply of Homes For Sale decreased 17.6% to 1.4

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending November 6, 2021

For Week Ending November 6, 2021

Cash-out refinances are up 33% from October last year, Black Knight reports, as Americans seek to take advantage of low interest rates and double-digit gains in home equity over the pandemic. Driven by soaring home values, U.S. tappable home equity reached 9.1 trillion dollars in October, prompting an increasing number of borrowers to cash out some of their equity for debt consolidation, investment purposes, home improvement projects, and more.

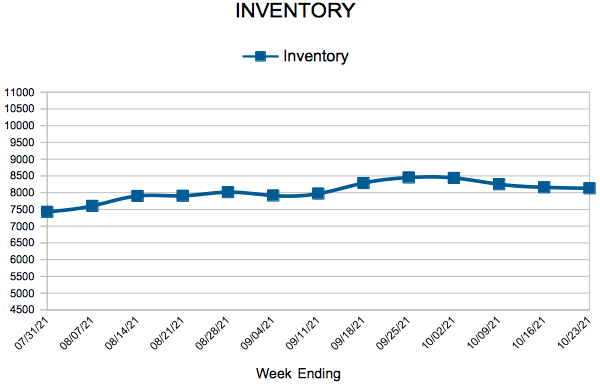

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING NOVEMBER 6:

- New Listings decreased 4.2% to 1,217

- Pending Sales decreased 6.0% to 1,178

- Inventory decreased 14.6% to 7,640

FOR THE MONTH OF OCTOBER:

- Median Sales Price increased 7.9% to $340,000

- Days on Market decreased 22.9% to 27

- Percent of Original List Price Received decreased 0.2% to 100.3%

- Months Supply of Homes For Sale decreased 17.6% to 1.4

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending October 30, 2021

For Week Ending October 30, 2021

Millennials are leading the housing boom, accounting for 37% of home purchase over the last year, according to Barron’s. Increasing net worth, household formation, low mortgage rates, and a robust economy are a few of the reasons behind the recent growth of homebuyers in this age segment. With Millennials representing 22% of the U.S. population–and with their peak earning years ahead—experts remain optimistic about this generation’s impact on the housing market.

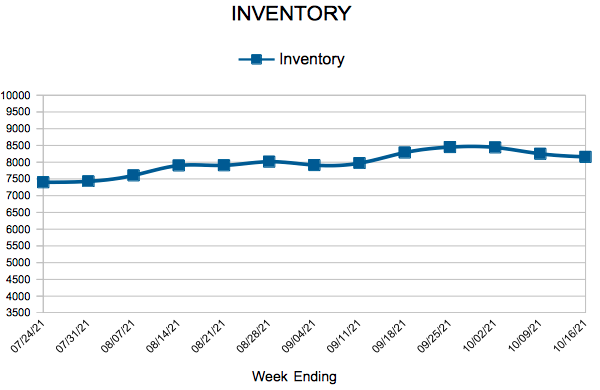

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING OCTOBER 30:

- New Listings increased 3.7% to 1,309

- Pending Sales increased 1.2% to 1,345

- Inventory decreased 13.8% to 8,025

FOR THE MONTH OF SEPTEMBER:

- Median Sales Price increased 9.9% to $340,700

- Days on Market decreased 37.8% to 23

- Percent of Original List Price Received increased 0.7% to 101.2%

- Months Supply of Homes For Sale decreased 15.8% to 1.6

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending October 23, 2021

For Week Ending October 23, 2021

Mortgage rates are on the rise, with the 30-year fixed-rate mortgage averaging 3.09% for the week ending October 21, 2021, according to Freddie Mac. Rates have climbed nearly one-third of a percent since early August. Despite increasing rates, which are projected to remain above 3% for the fourth quarter and rise even further next year, economists are expecting the housing market to continue to be active into 2022, thanks in part to strong buyer demand and increases in new listings.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING OCTOBER 23:

- New Listings decreased 5.3% to 1,343

- Pending Sales decreased 14.7% to 1,235

- Inventory decreased 15.8% to 8,130

FOR THE MONTH OF SEPTEMBER:

- Median Sales Price increased 10.0% to $340,850

- Days on Market decreased 37.8% to 23

- Percent of Original List Price Received increased 0.7% to 101.2%

- Months Supply of Homes For Sale decreased 21.1% to 1.5

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending October 16, 2021

For Week Ending October 16, 2021

The supply of entry-level housing is at its lowest level in nearly five decades, according to Freddie Mac, who reports that entry-level home construction decreased from 418,000 units per year in the 1970s to 65,000 units per year in 2020. The shortage of starter homes has proven challenging to first-time buyers, as many existing entry-level homes are being remodeled or demolished and replaced by much larger homes, while those that remain have become significantly more expensive, with sales prices increasing 64% from 2016, according to realtor.com.

In the Twin Cities region, for the week ending October 16:

- New Listings decreased 10.4% to 1,433

- Pending Sales decreased 12.7% to 1,305

- Inventory decreased 16.8% to 8,159

For the month of September:

- Median Sales Price increased 10.0% to $341,000

- Days on Market decreased 37.8% to 23

- Percent of Original List Price Received increased 0.7% to 101.2%

- Months Supply of Homes For Sale decreased 21.1% to 1.5

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

- « Previous Page

- 1

- …

- 11

- 12

- 13

- 14

- 15

- …

- 23

- Next Page »