December is normally one of the slowest months of the year, but strong buyer demand across most segments of the market, buoyed by near record-low interest rates, continues to drive a healthy sales pace in the face of a new wave of COVID-19 infections and a softening job market.

Mortgage Rates Move Down

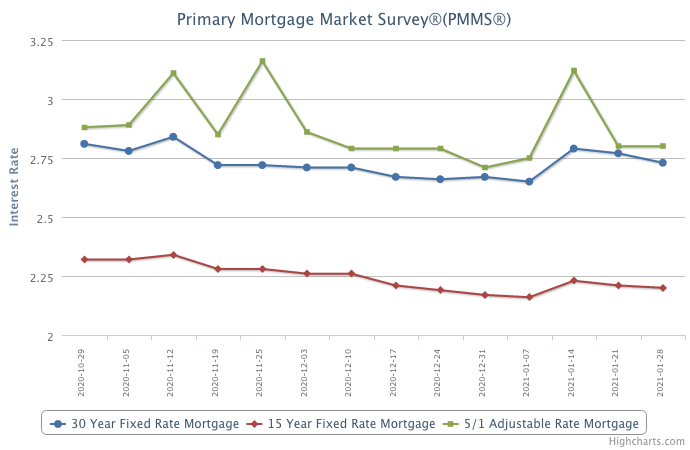

January 28, 2021

As the market reacts to a new administration in Washington and COVID-19 driven economic malaise, mortgage rates continued to decrease this week, just slightly. Even as house prices increase at the fastest rate we’ve seen in years, competition to buy is strong given the low inventory that exists across the country. The fact that there are not enough homes to meet demand is going to be an ongoing issue for the foreseeable future.

Information provided by Freddie Mac.

Mortgage Rates Move Slightly

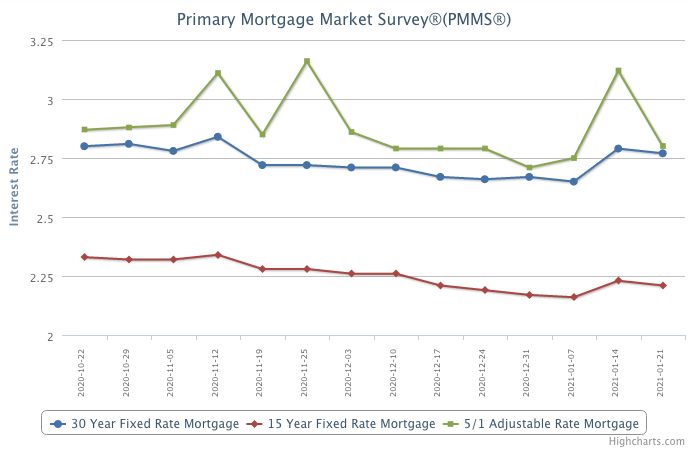

January 21, 2021

Mortgage rates have hovered near historic lows for almost a year, fueling purchase and refinance activity amid a global health crisis. We’re now seeing rates fluctuate a bit as political and economic factors drive Treasury yields higher. However, we forecast rates to remain relatively low this year as the Federal Reserve keeps interest rates anchored near zero for a longer period of time, if needed until the economy rebounds.

Information provided by Freddie Mac.

Mortgage Rates Tick Up

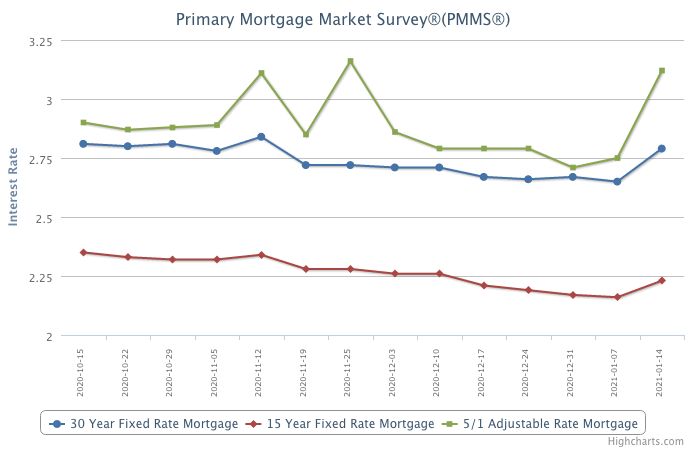

January 14, 2021

As Treasury yields have risen, it is putting pressure on mortgage rates to move up. While mortgage rates are expected to increase modestly in 2021, they will remain inarguably low, supporting homebuyer demand and leading to continued refinance activity. Borrowers are smart to take advantage of these low rates now and will certainly benefit as a result.

Information provided by Freddie Mac.

Mortgage Rates Inch Up

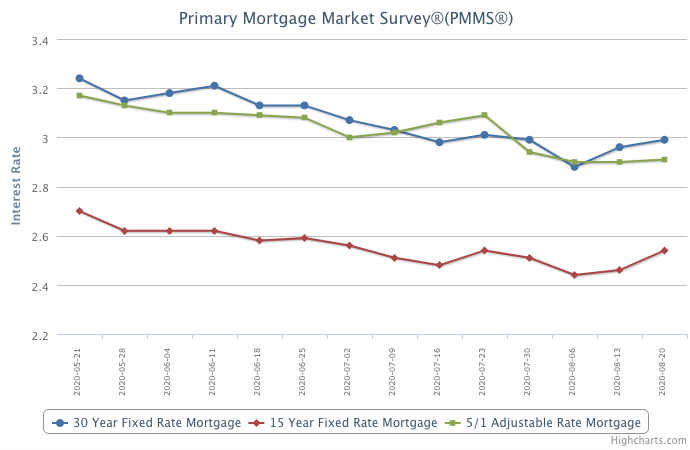

August 20, 2020

Purchase housing demand continues to accelerate, ultimately providing support to an economy that otherwise has stagnated. The surge in sales led to a rapid increase in the demand for remodeling and home furnishings as consumers look to renovate while adjusting to home life during COVID.

Information provided by Freddie Mac.

Mortgage Rates Move Up

August 13, 2020

Homebuyer demand remains strong, especially for those in search of an entry-level home where the improvement in affordability via lower mortgage rates has a material impact. Even with this week’s uptick, very low rates are providing a significant boost to the housing market that continues to hold up well during this time of uncertainty.

Information provided by Freddie Mac.

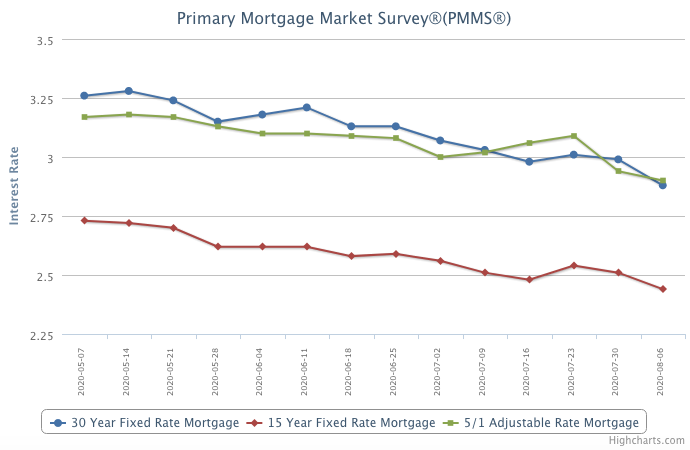

Mortgage Rates Drop, Hitting a Record Low for the Eighth Time this Year

August 6, 2020

The resilience of the housing market continues as mortgage rates hit another all-time low, giving potential buyers more purchasing power and strengthening demand. We expect rates to stay low and continue to propel the purchase market forward. However, the main barrier to rising demand remains the lack of inventory, especially for entry-level homes.

Information provided by Freddie Mac.

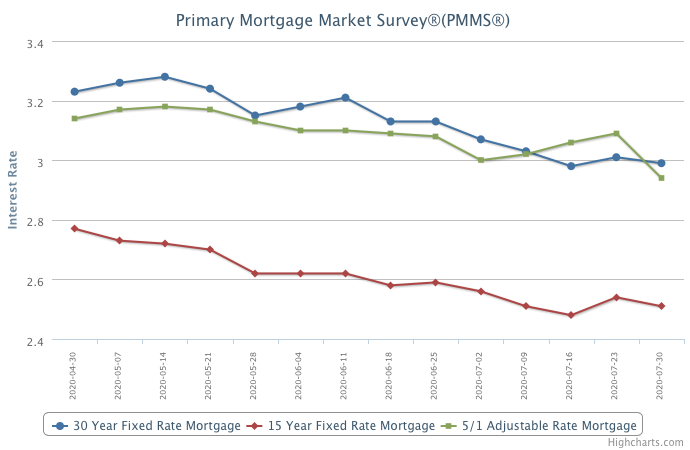

Mortgage Rates Decrease Slightly

July 30, 2020

Rates continue to remain near historic lows, driving purchase demand over 20 percent above a year ago. Real estate is one of the bright spots in the economy, with strong demand and modest slowdown in home prices heading into the late summer. Home sales should remain strong the next few months into the early fall.

Information provided by Freddie Mac.

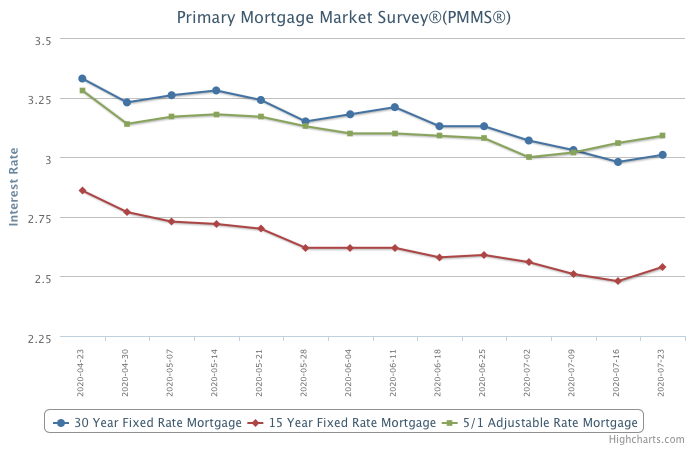

Mortgage Rates Rise for the First Time in Weeks

July 23, 2020

While housing demand continues to rebound, the month-long swoon in economic activity has caused the 10-year Treasury benchmark to drop. In the short-term, this means the demand will continue on the back of near record low mortgage rates. However, the most recent consumer spending data has been pointing to slow growth since mid-June. The concern is that the pause in economic activity will cause unemployment to remain elevated which will lead to longer-term labor market distress.

Information provided by Freddie Mac.

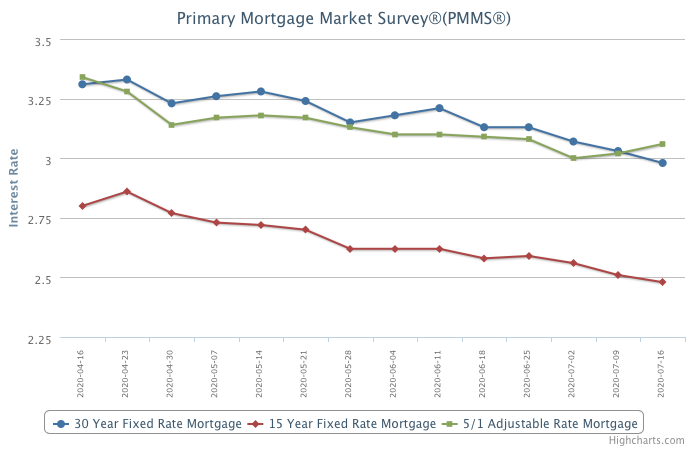

Mortgage Rates Fall Below Three Percent

July 16, 2020

Mortgage rates fell below 3 percent for the first time in 50 years. The drop has led to increased homebuyer demand and, these low rates have been capitalized into asset prices in support of the financial markets. However, the countervailing force for the economy has been the rise in new virus cases which has caused the economic recovery to stagnate, and this economic pause puts many temporary layoffs at risk of ossifying into permanent job losses.

Information provided by Freddie Mac.

- « Previous Page

- 1

- …

- 5

- 6

- 7

- 8

- Next Page »